Portfolio overview

We are invested in some of the biggest global brands

£12.3 billion

Global Public Equities

Our Public Equities portfolio consists of six distinct mandates, managed in-house. These mandates are designed to capture growth across various sectors and geographies, ensuring a well-diversified and strategic approach.

We own IDB bonds to support Economic & Social Development in Latin America

£3.3 billion

Fixed Income

Our fixed income mandate totals £2.9 billion, managed in-house, this portfolio is carefully diversified across the bond market, allowing us to preserve capital while generating steady income.

Through GLIL we invest directly in some of biggest UK offshore windfarms

£1.3 billion

Infrastructure

Our Infrastructure mandate supports a diversified investment strategy through GLIL and WYPF allocations. GLIL focuses on UK core infrastructure, like LYCEM Solar and Hornsea 1, while WYPF targets additional domestic and global opportunities.

Through Gritstone we support the development of spin-outs from Northern universities

£1.2 billion

Private Equity

Our Private Equity mandate includes the Northern Private Equity Pool (NPEP) and the WYPF Private Equity Allocation. Formed in 2018, NPEP pools investments across Northern Local Government Pension Scheme (LGPS) funds, boosting investment capacity and fostering collaboration to target high-growth businesses.

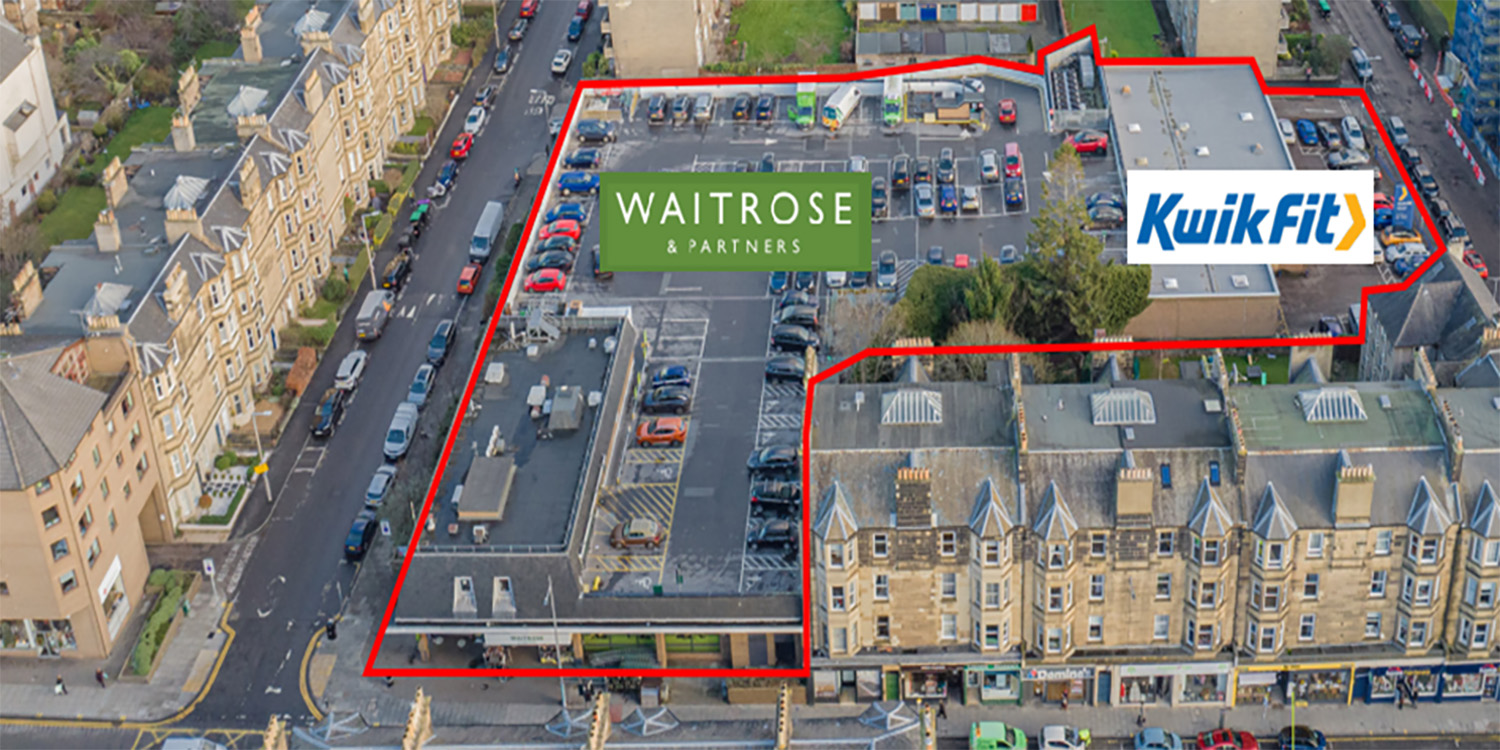

We invest in commercial property throughout the UK

£514 million

Property

Our Property Mandate focuses on investing in high-quality real estate assets to generate stable income and long-term capital appreciation. This strategy encompasses a diversified portfolio of commercial, residential, and industrial properties, strategically located to capitalize on market demand.

We have invested in Rebalance earth to support nature based solutions

£738 million

Alternatives

Our Alternative Mandate focuses on both public and private market investments to enhance returns, reduce risk, and align with our prioritized UN SDG themes of Climate Solutions, Sustainable Cities and Innovation Growth. Key areas include Energy Transition, Natural Capital, Sustainable Places and Innovation, aiming to boost portfolio resilience and generate uncorrelated returns and impact.